Investing in the Boeing stock market can be a perplexing venture, especially when it comes to significant players like Boeing. Boeing stock represents not only a major a component of the aerospace sector but also serves as a bellwether for various economic indicators. As an investor, understanding what influences Boeing’s stock performance can equip you with the necessary knowledge to make informed decisions. This article delves into various aspects of Boeing stock, including historical performance, recent developments, analyst ratings, and future predictions, providing you with a comprehensive perspective.

What Influences Boeing Stock Prices?

Boeing stock prices are influenced by a myriad of factors ranging from the broader economic outlook to specific company announcements. Major contracts with airlines for new aircraft and defense contracts can drive the stock up, while issues like production delays or safety concerns can lead to a decline. Global oil prices also play a crucial role, as fluctuations can affect airline operating costs and impact flight demand. Additionally, geopolitical factors, regulatory changes, and technological advancements further impact how investors view Boeing stock. Staying abreast of these influences is vital for making sound investment decisions, as they can create both opportunities and risks for potential stockholders.

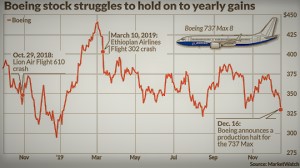

A Historical Perspective on Boeing Stock Performance

Historically, Boeing stock has shown substantial volatility, largely reflecting the myriad challenges the aerospace industry faces. For instance, the stock enjoyed a robust rally in the years leading up to 2019, buoyed by high demand for commercial aircraft. However, the COVID-19 pandemic hit the airline industry hard, leading to a significant decline in Boeing stock prices. Charting this historical journey helps investors recognize past trends and prepare for future uncertainties. Moreover, having insight into Boeing’s previous cycles of recovery post-crisis can inform investors about potential turnaround times for the current downturn. Understanding this historical context can become a critical tool for strategic investment planning.

Recent Developments Impacting Boeing Stock

Recent events have had a pronounced impact on Boeing stock, particularly surrounding the 737 MAX aircraft’s return to service after its temporary grounding due to safety concerns. Positive news regarding orders and deliveries is crucial as they can influence investor sentiment. Additionally, recent partnerships in defense contracts have bolstered confidence in the stock, contributing to an uptick in prices. However, ongoing supply chain disruptions and economic uncertainties persist, which are closely monitored by analysts. Keeping abreast of these developments is paramount, as they serve as immediate indicators of whether Boeing stock may appreciate or depreciate in value in the short term.

Comparing Boeing Stock to Its Competitors

When evaluating Boeing stock, it’s beneficial to compare it to its key competitors, such as Airbus and Lockheed Martin. While Airbus often competes closely in the commercial aircraft sector, Lockheed Martin holds a more significant presence in defense. The comparative performance of Boeing stock relative to these companies can provide insight into its relative valuation and competitiveness within the market. For example, if Boeing’s stock is underperforming its competitors despite favorable market conditions, it could signal internal issues or a lack of investor confidence. Therefore, engaging in comparative analysis enriches your understanding and provides vital metrics for investment evaluation.

How Global Events Affect Boeing Stock Value

Global events significantly affect Boeing stock, often acting as catalysts for market movements. For instance, military conflicts can lead to increased defense spending, which benefits companies like Boeing. Conversely, political unrest or economic downturns can lead to reduced travel demand, directly impacting Boeing’s commercial endeavors. The COVID-19 pandemic demonstrated this phenomenon dramatically, showcasing how quickly the demand for air travel can evaporate due to unforeseen circumstances. Investors should remain vigilant in observing global news, as these events can have both immediate and long-term repercussions on Boeing stock performance.

Analyst Ratings: What Experts Say About Boeing Stock

Analyst ratings can provide valuable insights and serve as indicators of market sentiment towards Boeing stock. Investment firms frequently evaluate Boeing based on growth potential, earnings, and competitive positioning. A strong buy recommendation may suggest confidence in the company’s future, while a downgrade could signal caution. Major investment houses like Goldman Sachs and Morgan Stanley often produce comprehensive reports analyzing the fundamentals of , which investors should consider alongside other metrics. By adhering to these expert analyses, investors arm themselves with essential tools for evaluating their next moves regarding Boeing stock investments.

Investing Strategies for Boeing Stock: Short-term vs. Long-term

Developing a robust investment strategy when it comes to Boeing stock involves deciding on a short-term versus long-term approach. Short-term investors may focus on market fluctuations and news events, implementing strategies to capitalize on price swings. Conversely, long-term investors may prioritize Boeing’s growth potential and fundamentals, focusing on the company’s visionary roadmap and operational improvements. Both methods have their merits and challenges; short-term investing can offer quick gains but comes with heightened risk, while long-term investing typically necessitates patience and a belief in the company’s sustained growth trajectory. Understanding your investment strategy will help tailor your approach towards more effectively.

Boeing Stock Dividends: What Investors Should Know

Boeing stock has historically offered dividends, making it an attractive option for income-focused investors. While dividends can provide a steady income stream, it’s essential to pay attention to the company’s dividend history during turbulent times. For example, during the pandemic, Boeing suspended its dividend, which led to significant investor concern over its financial health. Tracking the company’s dividend payout ratio and examining its cash flow can help gauge its future ability to pay dividends. Being informed about the recent trends in Boeing’s dividend policy is vital for any serious investor contemplating long-term commitments.

The Role of Technology Advancements in Boeing’s Stock Growth

Technological advancements play a pivotal role in Boeing’s competitive edge and, subsequently, its stock growth. Innovations in fuel efficiency, safety, and in-flight technology can set Boeing apart from its competitors, potentially driving investor confidence and stock prices higher. The company invests heavily in research and development to remain at the forefront of these technological improvements. Recent advancements in sustainable aviation technology may also attract environmentally conscious investors. Monitoring these developments provides valuable insights into Boeing’s future position in a rapidly evolving industry, which can have a direct correlation to its stock performance.

Future Predictions: Where Is Boeing Stock Headed Next?

Looking ahead, various factors will inevitably influence the trajectory of Boeing stock. With increasing global demand for air travel as economies rebound, Boeing has an opportunity to regain lost ground. However, investors should also consider ongoing supply chain disruptions and regulatory environments that may impact production timelines. Analysts are mixed in their predictions; some foresee a robust recovery based on anticipated demand, while others urge caution due to persistent risks. Keeping an eye on these variables—and how they may affect Boeing’s operations—will help investors make informed choices regarding when and how to engage with Boeing stock in the coming months.

Conclusion

In summary, navigating the complexities of Boeing stock requires an informed approach, enriched by a comprehensive analysis of both historical trends and current events. The factors influencing stock prices, competitive analyses, and expert recommendations are all crucial in shaping investment strategies. Whether you are eyeing short-term gains or long-term growth, understanding Boeing’s market positioning and technological advancements will inform your decisions. By continuously monitoring developments relating to Boeing stock and keeping abreast of global events, you can position yourself for success in this evolving sector.

FAQs

What factors influence Boeing stock prices?**

Many factors, including contract acquisitions, production rates, global events, and investor sentiment significantly influence Boeing stock prices.

How has Boeing stock historically performed?**

Historically, Boeing stock has been volatile, reflecting challenges in the aviation industry, particularly during crises like the COVID-19 pandemic.

Should I invest in Boeing stock for dividends?**

Boeing has previously offered dividends, but investors should check its current policy and financial stability concerning dividend sustainability.

How do global events impact Boeing stock?**

Global events, such as political unrest or changes in the airline industry, can greatly affect Boeing stock by influencing demand for air travel.

How do global events impact Boeing stock specifically?**

Global events, such as conflict, regulatory changes, and economic downturns, can affect airline travel demand, which in turn impacts Boeing’s aircraft sales and stock performance.

What should novice investors know about Boeing stock?**

Novice investors should understand Boeing’s market position, keep an eye on industry trends, and be aware of both the risks and opportunities associated with investing in aerospace stocks.

How do analysts rate Boeing stock?**

Analysts provide ratings based on various fundamental indicators. Ratings typically vary from “buy” to “sell,” reflecting their expectations for Boeing’s financial performance and market conditions.

What are the risks involved in investing in Boeing stock?**

Risks include production delays, investigations into safety issues, economic downturns, and increasing competition from rivals like Airbus, all of which can negatively impact stock prices.

How does Boeing compare to its main competitors?**

Boeing competes primarily with Airbus in the commercial sector and Lockheed Martin in defense. Comparing their performance and market strategies provides additional insights for investors.

What are the industry trends affecting the future of Boeing stock?**

Key trends include the recovery of air travel demand post-pandemic, advancements in sustainable aviation technology, and evolving defense contracts, all of which could shape Boeing’s stock trajectory going forward.